Is there an inherent potential for a conflict of interest when the same firm of accountants that audits a company’s accounts also does a considerable amount of consultancy work for them? Their professional standards body states these organisations have a duty to be transparent and professional in their reporting. However, they also have a commercial directive to protect their income stream. This may work well in most circumstances, but what about when these potentially opposing priorities conflict? Which one will win out?

Is there an inherent potential for a conflict of interest when the same firm of accountants that audits a company’s accounts also does a considerable amount of consultancy work for them? Their professional standards body states these organisations have a duty to be transparent and professional in their reporting. However, they also have a commercial directive to protect their income stream. This may work well in most circumstances, but what about when these potentially opposing priorities conflict? Which one will win out?

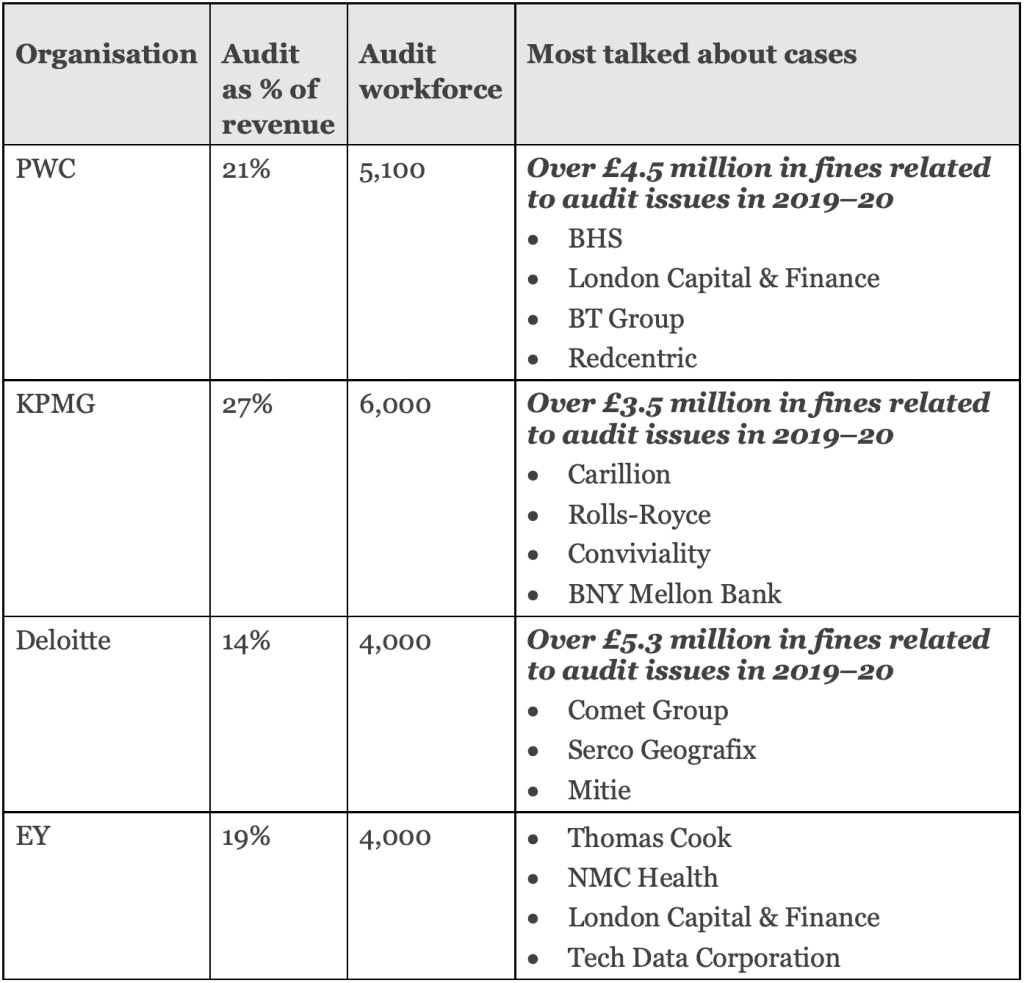

Each one of the ‘Big Four’ has suffered from media attention on this very subject in recent years and we recently wrote about the report of EY’s alleged involvement in the Wirecard fraud investigation. This has become such a widespread issue that the Financial Reporting Council (FRC) has conducted its own investigation into the question of conflicting interest in the audit profession.

It recently published its findings along with a list of recommendations, which it believes would be a fundamental shift for the sector. It suggests, amongst other findings, that more distance should be developed between the consulting and auditing sides of accounting firms. While some media observers suggest this is going too far, others believe it simply is not going far enough to repair the damage numerous high-profile accounting failures are suggested to have wrought on the sector over the last few years.

Conflict of Interest: Some high-profile cases

The Times recently did an exposé on just this story, identifying not only the investigations and fines suffered by the Big Four, but also the relative percentage of revenue that auditing accounts for in those organisations and the thousands of employees they have dedicated to the task.

The Root of the Problem

The issue is that, apparently, ‘audit only’ work accounts for around a fifth of the revenue of the average Big Four organisation, while far more profitable consulting work makes up the rest. The report asks what incentive do these organisations have to improve the quality and independence of their auditing, and raise their heads above the parapet to shout foul (where appropriate) on the very clients that are making up the other four-fifths of their turnover?

The Institute of Chartered Accountants for England and Wales (ICAEW) has a code of ethics which ‘requires’ accountants to be mindful of the possibility of influence which could impact on their ability to carry out their duties in an unbiased way.

It expects accountants to have sufficient safeguards in place to ensure that their independence when conducting an audit is not potentially compromised. However, the potential for conflict of interest still exists, so, what needs to happen is for there to be a stronger set of operating governance around the rules for accountants to follow on how to practically mitigate those threats.

The FRC’s Solution

It is reported that the FRC has been working on its recommendations for the last two years, since the collapse of Carillion shocked the audit sector. They include:

- Creating a firewall between audit and other activities of an organisation

- Separate accounting and reporting for audit departments

- Separate board appointed to oversee audit department

- Change to pay structure of those employed in audit.

According to The Times “PWC, Deloitte, KPMG and EY will have to submit their plans for structural separation to the FRC by the end of October and will need [to] implement the changes by June 2024”. If these firms implement any additional changes to their governance before the deadline, that will be genuinely leading by behaviour and will instil greater confidence.

The aim of the FRC’s recommendations is to improve public confidence in the auditing work the accounting sector is responsible for and to spare companies (and their shareholders, suppliers and staff) the trauma of more investigations, fines and uncertainty about the financial robustness of organisations.

The FRC is reported to have stated that these changes should “prioritise audit quality and protect auditors from influences from the rest of the firm that could divert their focus away from audit quality”.

Four tips for greater confidence when engaging audit partners

While the FRC has started the process of these compliance changes, they are still some time away from required implementation. We have listed below some of the key considerations to put into place when engaging audit partners:

-

Evidence early compliance with FRC recommendations

The FRC’s four recommendations are sensible measures for any accounting firm to have in place. In fact, they are measures that reflect the sector’s current code of conduct and the way the industry has been travelling since the accounting scandal that involved Arthur Andersen and Enron in 2001. Therefore, it would be a sensible baseline for greater confidence in your audit partners if they were able to evidence compliance with the FRC’s recommendations at the present time.

-

Remain engaged in your partnership

Issues are likely to occur in any strategic partnership. The intelligent client skill is being able to identify them early enough to correct any course of action before matters become too misaligned. While your audit partners will no doubt be experts in their field, it is still important to maintain both in-house audit knowledge to understand what should and should not be done and asked, and partnership engagement to recognise when your audit partner may not be asking the right questions.

-

Swift and decisive relationship management

Once a deviation from expected practices has been identified, it’s how you handle this that will determine the impact to both your organisation and the relationship. You will want to pivot your strategic partner’s behaviour or practices to realign them with those you’d expect of them. This will mean a combination of quickly raising the matter with your audit counterparts and a collaborative approach to both determining a solution and a way of dealing with any adverse impact already done. Swift and decisive collaborative action will set the right tone to ensure that these issues are less likely to be repeated in the future.

-

Know your contract (or Letter of Engagement)

The swift and decisive action you take should be governed by the knowledge you have of the inner workings of your Letter of Engagement. It’s important to fully understand your rights within the agreement, and to determine how far you can go before determining how far you should go to draw what you need from the relationship without causing an erosion of commercial trust. However, should further action be required, your detailed knowledge of your Letter of Engagement will be invaluable.

Conclusion

The Big Four were asked to submit an implementation plan to the FRC by 23 October 2020 and though the transition needs to be completed in just under four years’ time, the FRC will be agreeing a ‘transition timetable’ with each firm individually. An article published on the FRC website in July stated that: “Thereafter the FRC will publish annually an assessment of whether firms are delivering the objectives and outcomes of operational separation.”

While, in our opinion, these seem like sensible measures, you will need to decide whether you wish to wait for the almost four years of this timeline to conclude before you make any changes to the expectations you have of your auditors. Or if you think compliance with these fundamental principles is more appropriate right now, contact us for an informal discussion as to what you need to consider to implement this approach.

Photo credit: iStock